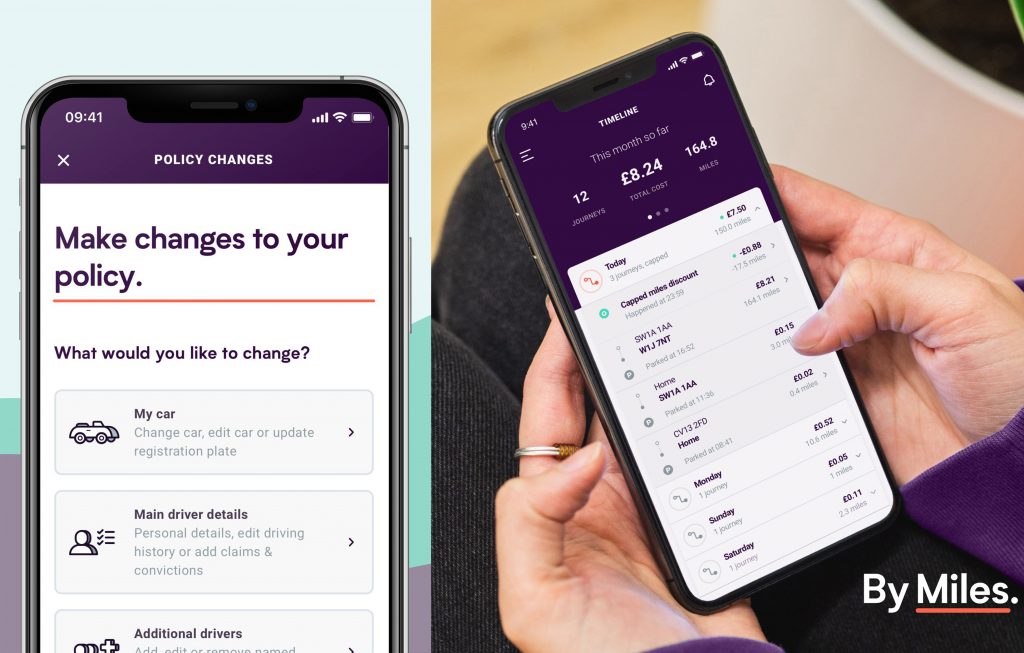

By Miles, founded in 2016, is a pay-per-mile insurance provider based in the United Kingdom. With a mission to make driving fairer for low mileage drivers, the company provides a tracker that plugs into the car to log miles driven, or, alternatively, uses built-in telematics on newer vehicles to track distance. The company offers services such as vehicle tracking, troubleshooting, accident detection, and a 24-hour claims line. In recognition of By Miles’ innovation and product benefits, changing the landscape of the future, the World Future Awards has selected them as the winner in the category of Financial Service, for Neo Insurance.

Dedicated to seeking better prospects for society, the World Future Awards honor, celebrate, and promote products, software, and services that will transform the global economy and define the landscape of the future. The organization researches inventions that are making the world better, smarter or even just a bit more fun.

As of January 2021, By Miles served more than 25,000 customers. The company entered Italy in March 2022, in line with its broader plans to expand its footprint further in Europe by 2023.

New insurance models are disrupting this centuries-old industry, focussing on personalization and convenience, and providing coverage for the connected consumer. In January 2021, By Miles announced the commercialization of its internally developed usage-based insurance (UBI) platform “By Bits.” The new platform would be offered through a software-as-a-service (SaaS) model.

Neo Insurance, currently in its early product stage, refers to a turnkey solutions, fully digitized insurance product and service provided entirely through digital channels. These new insurance models, which use new technologies, offer a fairer kind of car insurance for lower mileage drivers. The new models allow them to focus heavily on customer experience by providing personalized products that are tailor-made to reflect individual circumstances better, allow for instant coverage, and let you process claims much faster. The ultimate goal is to move away from traditional insurance, where ‘blanket rules’ have dominated the industry since inception.

A great demand for more personalized policies has emerged amongst consumers, as well as cost saving for insurers, which has led to a strong demand for neo insurance products and supporting infrastructure solutions. Traditional insurers have been unable to provide adequate coverage for non-conventional industries, such as ridesharing, and this has paved the way for new opportunities for neo insurers.

An incredibly fast-growing industry, the market size for the US neo-insurance market is projected to reach USD 53.2-79.9 billion by 2025.

For more on this company, visit their website at https://www.bymiles.co.uk/