Championing Change in Fintech: A Conversation with Dr. Jasmin B Gupta, WFA’s Newest Board Member

Dr. Jasmin B Gupta, a renowned fintech expert and enterprising leader, has recently joined World Future Awards as its newest board member.

With over two decades of experience in digital and consumer banking, Dr. Gupta has been at the forefront of driving innovation and financial inclusion in India and beyond. She has held leadership roles at Equitas Bank, Kotak Mahindra Bank, and HDFC Bank and played a pivotal role in launching two of India’s leading digital banks, NiyoX and FreoSave.

Dr. Gupta’s appointment brings a wealth of knowledge and forward-thinking insights to World Future Awards. In this exclusive interview, we explore her journey, accomplishments, and her vision for the future of fintech and digital transformation.

World Future Awards: With two decades of experience in fintech and banking, what inspired you to focus on co-founding Lxme & MeitMoney and how do you see its impact evolving in the future?

Dr Jasmin B Gupta: The first two decades of the career are focused on learning and leadership, the next two are focused on giving back and impact. And that’s what inspired me to launch innovative platforms around financial education and inclusion. As per World Bank’s Global Findex data, while the financial inclusion index has improved, there is still a lot that needs to be done to achieve inclusion in true letter and spirit by improving not just access but also financial literacy, quality and usage. Fintechs by focusing on niche segments such as women, youth, MSMEs, gig-workers, etc. are better placed to drive deeper wholistic digital financial inclusion across savings, payments, investments, insurance & credit.

WFA: You’ve led the launch of two of India’s leading digital banks, NiyoX and FreoSave. What were the most significant challenges you faced during these projects, and how did you overcome them?

JG: While world over we see licensed Digital Banks such as Revolut or Monzo, India still believes in Partnership based Digital Banks. Hence NiyoX and FreoSave had its fair share of collaboration challenges where agile innovative fintechs learn to work with highly regulated process-driven Banks. It’s about bringing the best of both worlds together, where the ultimate winner is the customer. It’s also an opportunity for both sides – banks and fintechs to understand and appreciate what each side brings to the table. So, while I have seen banks learning/unlearning Customer Experience and Innovation, I have seen fintechs learning Fraud Control and Risk Management. It is a win-win.

WFA: As someone who has won numerous awards, such as the Fintech Leader of the Year and Global Fintech Excellence in Leadership Award, how have these recognitions shaped your approach to leadership and innovation in the fintech space?

JG: Fintech is one space where you can lead innovation by creating fresh solutions to unsolved problems. As a banker with in-depth financial knowledge and digital expertise, I realized that building research-based innovative solutions backed by the right domain skills and know-how, can lead to disruption in the market. While awards and recognitions are indeed motivating stepping stones, impact is what matters most when you are building towards leaving a legacy behind.

WFA: Financial inclusion and digitalization are at the heart of your PhD. How do you think the integration of these two areas will transform banking in the next 5-10 years, especially for underserved communities?

JG: There is no faster way to achieve financial inclusion, other than making it digital or phygital. Smartphone penetration has increased 10x in the last ten years and every household today has at least one smartphone. Just last month I launched – a cutting-edge multi-lingual App – PahalSangini – India’s first financial inclusion platform for women offering financial literacy, credit, payments, insurance, e-commerce, etc. all rolled into one common mobile application, for rural women. While this is just one solution, there is scope for many such digital innovations to achieve financial penetration in the underserved communities.

WFA: You’ve been associated with prominent institutions like Equitas Bank, Kotak Mahindra Bank, and HDFC Bank. How did your experiences at these organizations prepare you for your founder role and shape your leadership philosophy?

JG: HDFC Bank, one of the largest and leading banks in the world, was a great learning school for me where I learned real banking with its stringent processes & regulations. I joined the Bank straight out of business school, through campus placement, and went on to become the youngest branch manager at the age of 25. Kotak Mahindra Bank offered a 360-degree banking perspective across multiple business, product, and digital functions along with an intrapreneurship exposure of leading several disruptive analytics and AI-based digital initiatives. And Equitas Bank opened up the world of fintechs for me, right from NiyoX to Lxme. From then on, there was no looking back as I jumped into the fintech world with the entire 360-degree banking perspective, giving me a unique edge in the space. And the best is yet to come…

WFA: As a global thought leader and a TEDx speaker, how do you ensure that you stay at the forefront of fintech innovation? What key trends do you believe will dominate the fintech industry in the coming years?

JG: I look forward to research, networking, forums and conferences, industry workshops, leadership meetings, etc. to contribute as well as to keep a tab on what’s happening in the space. Blockchain, AI, Defi, embedded finance, open banking, digital banks, cybersecurity, superapps, etc. are some of the key fintech trends expected to dominate the industry.

WFA: You’ve been recognized as a Top Performing Banker and a visionary digital leader. What career milestones do you consider your most significant accomplishments, and what advice would you give to young professionals aiming for leadership roles in fintech?

JG: There have been many career milestones, significant amongst which are getting awarded as Best Relationship Manager in Switzerland and Australia with highest scorecard of 351%; youngest branch manager at 25; doubling up 10 years of banking business in just 1 year; initiating Analytics and AI-based Digital solutions; launching India’s fastest growing neo-bank NiyoX with 2 million+ customers; co-founding India’s first financial platform for women LXME; launching India’s first financial inclusion platform PahalSangini and many more. My advice to young professionals aiming for leadership roles is to take risks early on without fearing failure and keep learning/unlearning continuously.

WFA: Aside from your professional career, you’ve represented India as a Youth and Cultural Ambassador and excel in various arts like dance and music. How do these diverse interests influence your work in fintech, and what role do creativity and versatility play in your success?

JG: I am a trained professional dancer and can dance in 10+ different dance forms right from Garba to Bharatnatyam to Salsa, performing dance shows in France, Spain & Japan. I have excelled in creative arts right from childhood, and hence when I took up banking, which is otherwise considered to be a very boring profession, I poured all my creativity into making it the most interesting job on earth. I have done creative banking all throughout and the same gets reflected in my various fintech initiatives as well. Innovation lies at the core of fintech, and I am a natural at it.

Thank you for sharing your time and insights today, Dr Gupta!

To learn more about our revered newest board member, visit her LinkedIn Profile here: https://www.linkedin.com/in/jasminbgupta-digitalbank/

MORE NEWS

World Future Awards Exclusive: Interview with Ronald van Loon — Top 30 Tech Voices 2025

Defining the Next Era of People Development

Speexx Awarded for Global Workforce Development Innovation

World Future Awards Releases Futurenomics Digital Issue #5

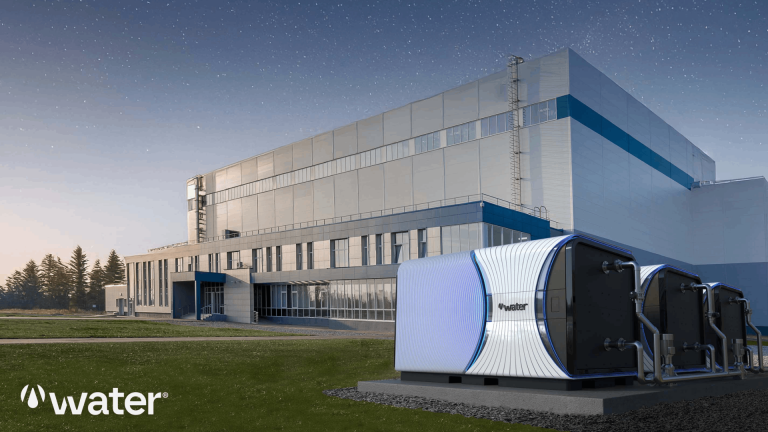

VVater Named One of World Future Awards’ Top 100 Next Generation Companies for 2025

VVater – Pioneering the Future of Water Technology

The 2025 Tech Christmas List: 11 Gifts for Forward Thinkers

NEWSLETTER

Sign up to learn more about our project and to stay up to date.